I surveyed customers to redesign Rivian Financial Services's offering page – increasing revenue by $5.28 million a year.

My role

Survey writing and creation

UX strategy and design

UI design

Copywriting

Prototyping

Presentation

Usability testing

Data analysis

Team

Lead UX Researcher

Copywriter

Manager, Digital Analytics

Engineering, Digital Analytics

Illustrator

Stakeholders

Director, UX Digital Design

Senior Product Manager

Director, Rivian Financial

Sr. Director, Rivian Financial

My role

Survey writing and creation

UX strategy and design

UI design

Copywriting

Prototyping

Presentation

Usability testing

Data analysis

Team

Lead UX Researcher

Copywriter

Manager, Digital Analytics

Engineering, Digital Analytics

Illustrator

Stakeholders

Director, UX Digital Design

Senior Product Manager

Director, Rivian Financial

Sr. Director, Rivian Financial

Background

With Rivian vehicles being unprofitable at the time of this project, tapping into profitable areas of the business was critical. I had an ambitious goal to redesign the financing page to increase revenue for the business and clarity for customers.

Goals

• Learn why customers do or do not choose Rivian to finance their vehicle

• Redesign the financing offerings page

• Increase revenue

Background

With Rivian vehicles being unprofitable at the time of this project, tapping into profitable areas of the business was critical. I had an ambitious goal to redesign the financing page to increase revenue for the business and clarity for customers.

Goals

• Learn why customers do or do not choose Rivian to finance their vehicle

• Redesign the financing offerings page

• Increase revenue

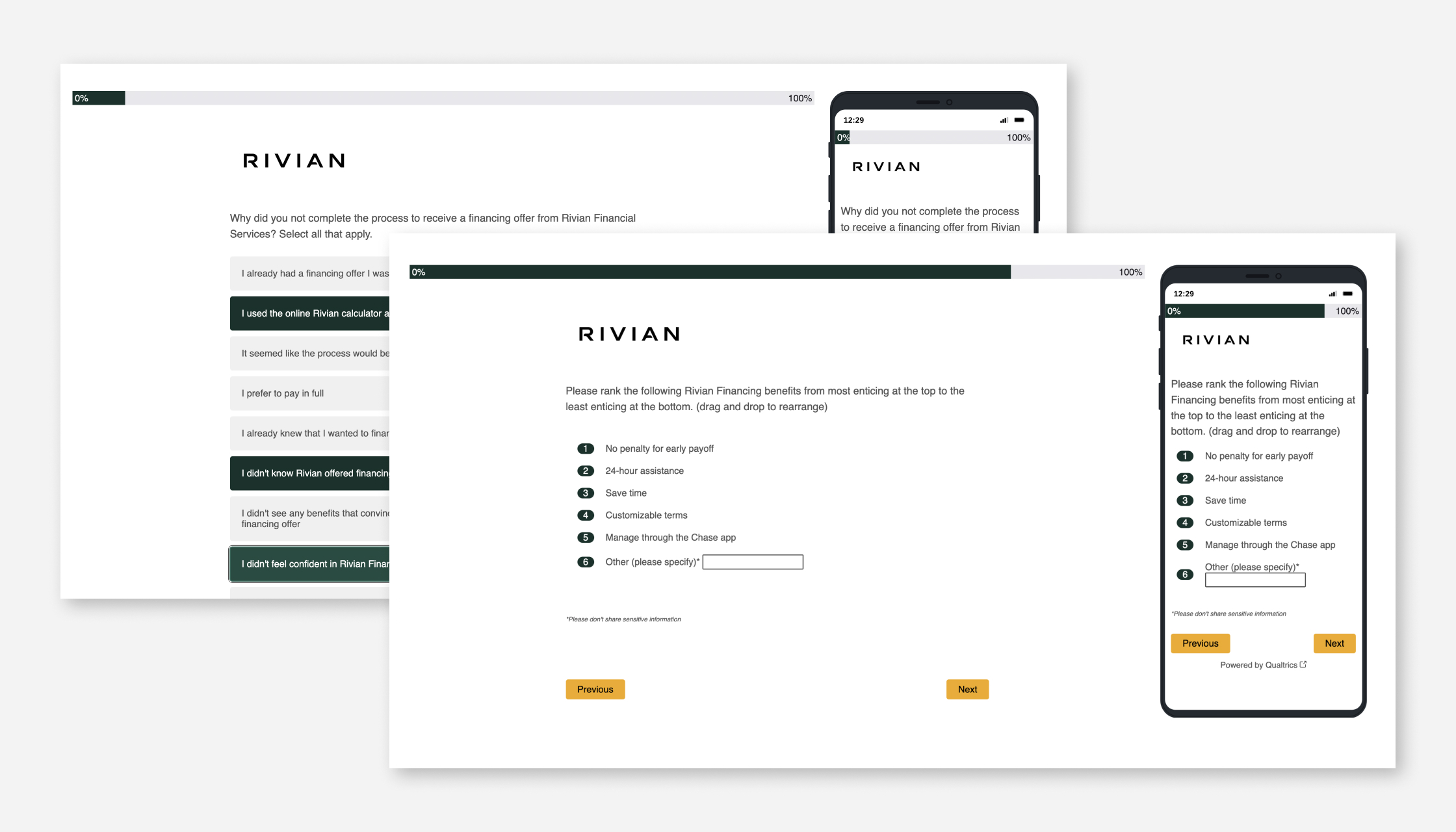

Data collection and survey writing

Before designing, it was imperative to collect data from real customers. My goal was to understand why or why not customers chose Rivian Financial Services and gather insight on what copy and design could influence to improve rates.

I started by conducting stakeholder interviews to gather data and assumptions from our in-house experts. That information helped me write a multi-step survey. I created the survey and consulted with our UX Researcher and Copywriter for feedback on research and brand and tone tips.

We launched the survey with customers who went through our finance process in the last 2 weeks and got 196 responses in a few days.

Data collection and survey writing

Before designing, it was imperative to collect data from real customers. My goal was to understand why or why not customers chose Rivian Financial Services and gather insight on what copy and design could influence to improve rates.

I started by conducting stakeholder interviews to gather data and assumptions from our in-house experts. That information helped me write a multi-step survey. I created the survey and consulted with our UX Researcher and Copywriter for feedback on research and brand and tone tips.

We launched the survey with customers who went through our finance process in the last 2 weeks and got 196 responses in a few days.

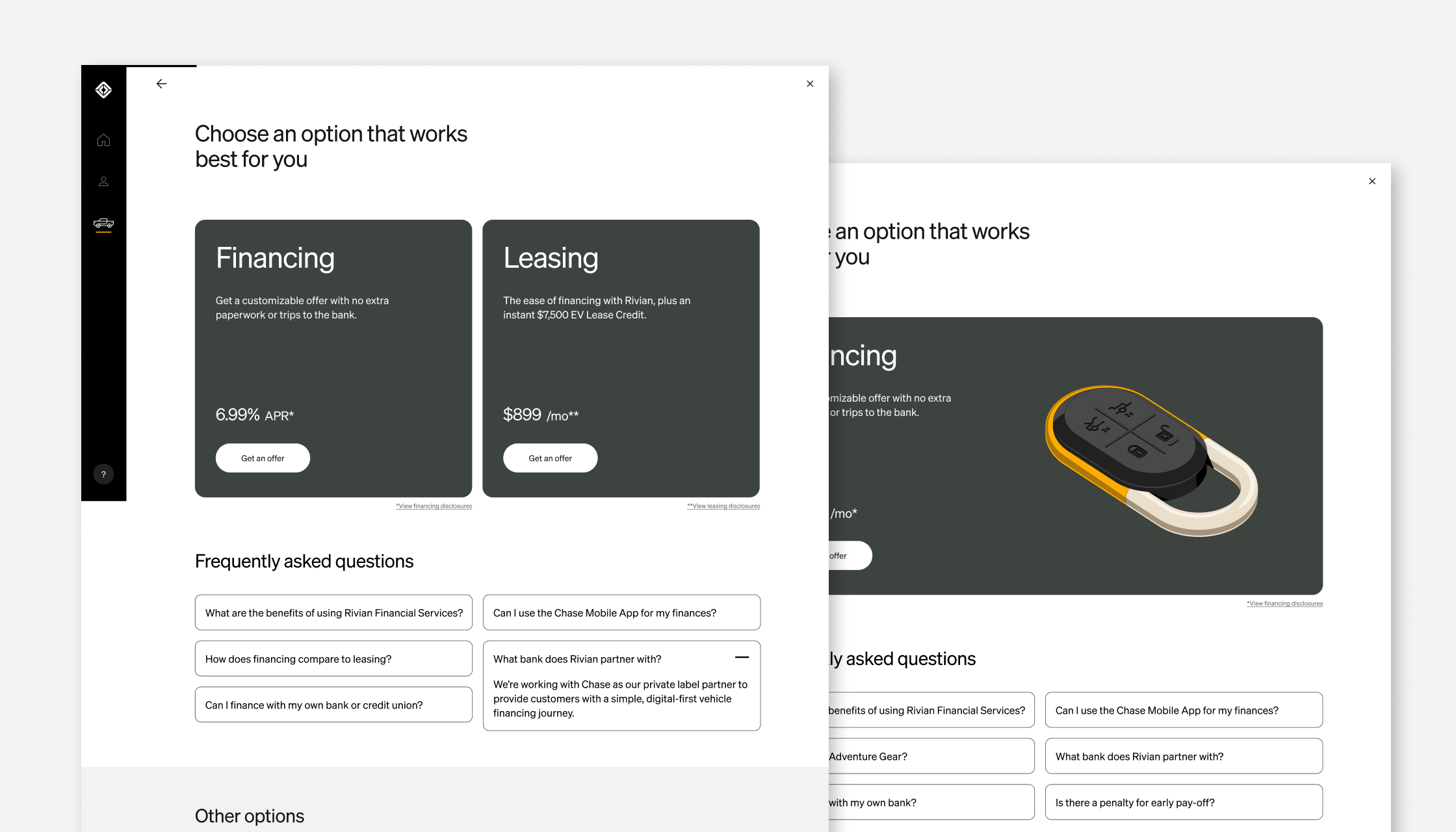

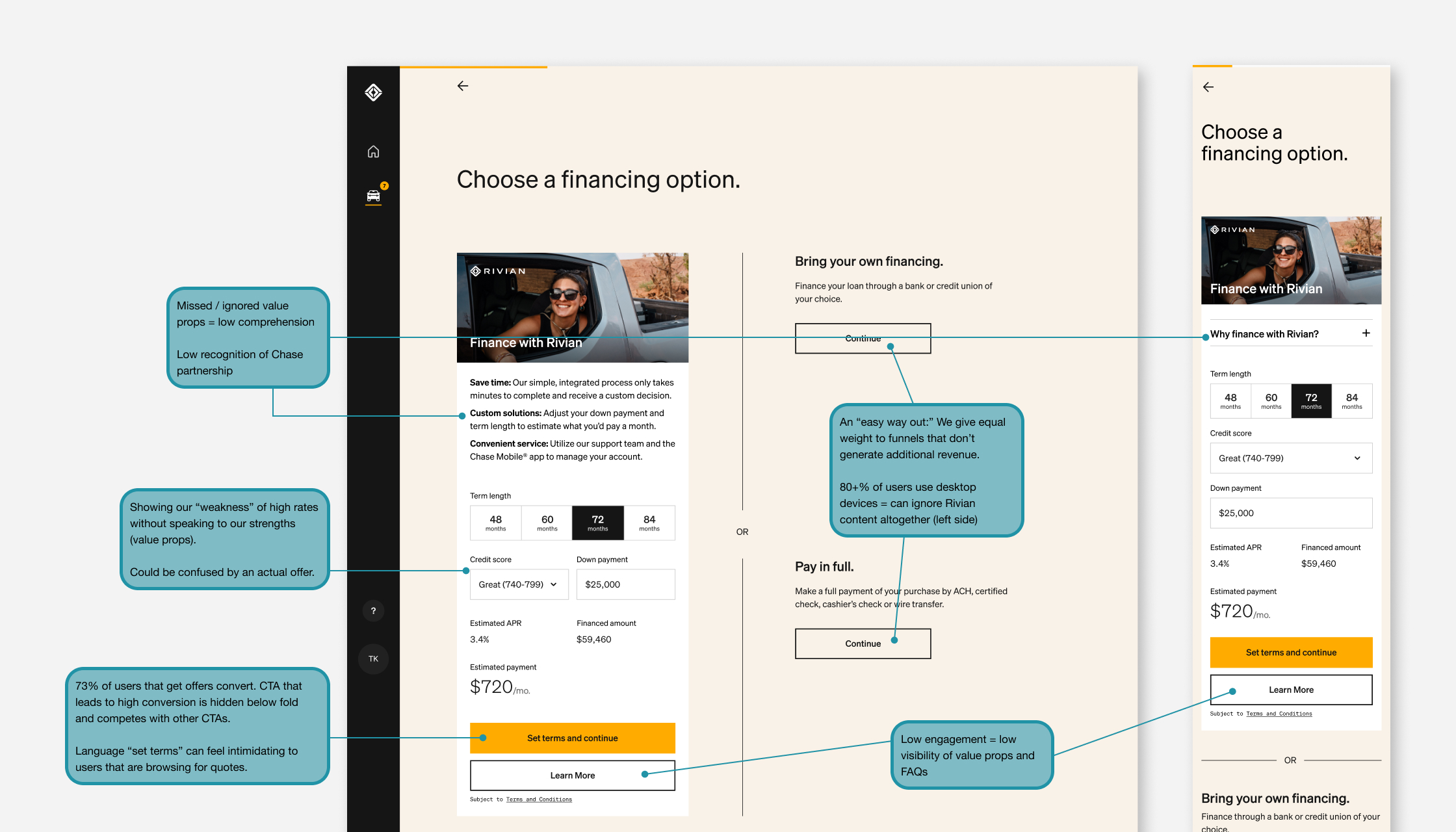

Audit

As we awaited survey responses, I completed an audit of our existing experience. I outlined assumptions of problematic areas based on the data and anecdotal notes I heard from our stakeholders and customers. This was the start to figuring out what design and copy could help influence to improve margins.

Discovery

After the survey had sufficient responses, I analyzed the data using Qualtrics. We learned several things: Customers largely prefered to pay for their vehicles in full. But, of the customers that financed, they chose Rivian Financial Services mainly because of convinience. Additionally, customers were not comprehending our value props as expected and customers who did start a finance application with Rivian were extremely likely to convert – this presented unique opportunities for a redesign.

I cosolidated the data and key takeaways in a presentation to share with stakeholders. This data was valueable for various teams across Rivian and shared with the team at Chase, including the president of auto loans.

Discovery

After the survey had sufficient responses, I analyzed the data using Qualtrics. We learned several things: Customers largely prefered to pay for their vehicles in full. But, of the customers that financed, they chose Rivian Financial Services mainly because of convinience. Additionally, customers were not comprehending our value props as expected and customers who did start a finance application with Rivian were extremely likely to convert – this presented unique opportunities for a redesign.

I cosolidated the data and key takeaways in a presentation to share with stakeholders. This data was valueable for various teams across Rivian and shared with the team at Chase, including the president of auto loans.

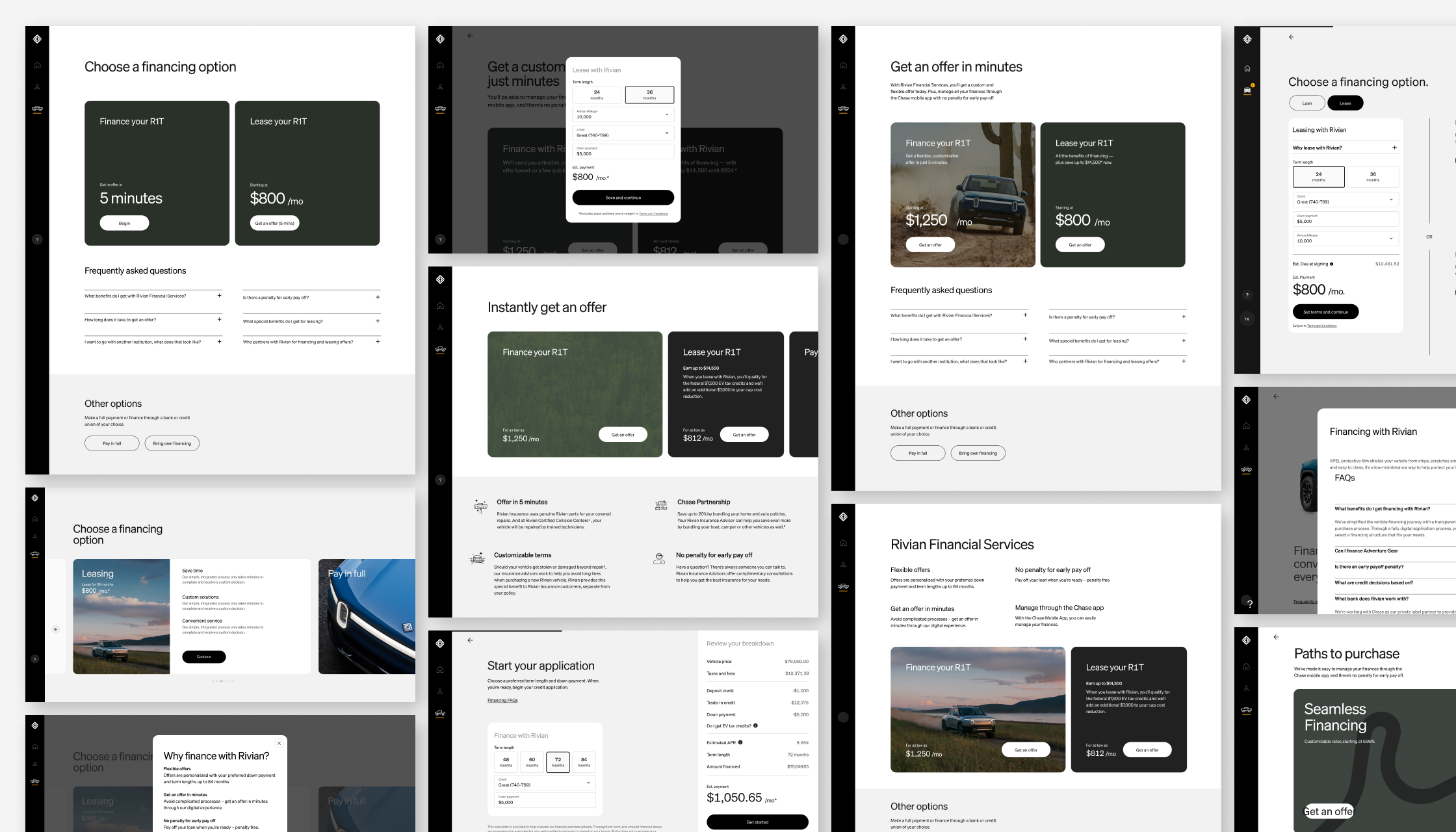

Data-driven design

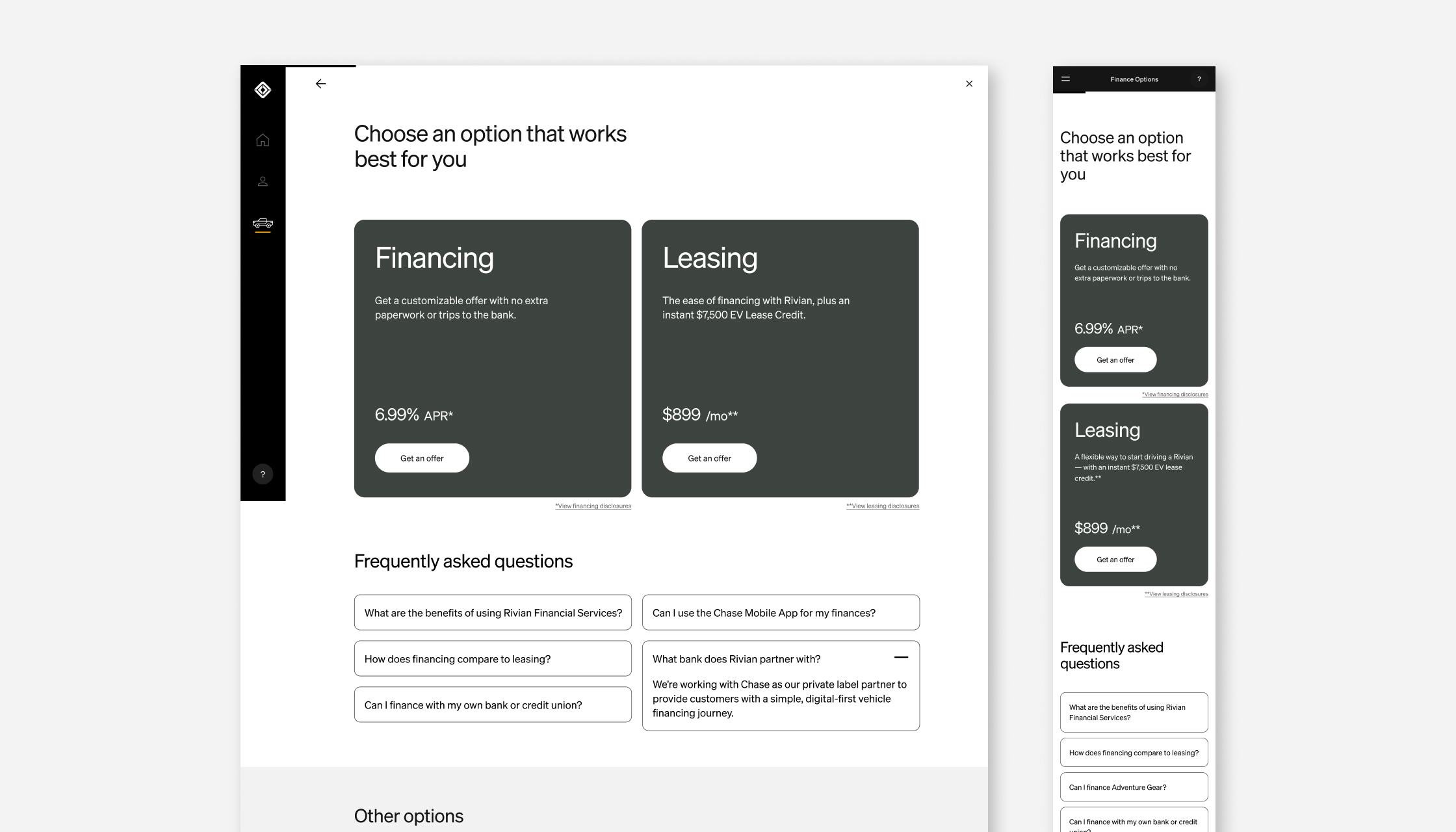

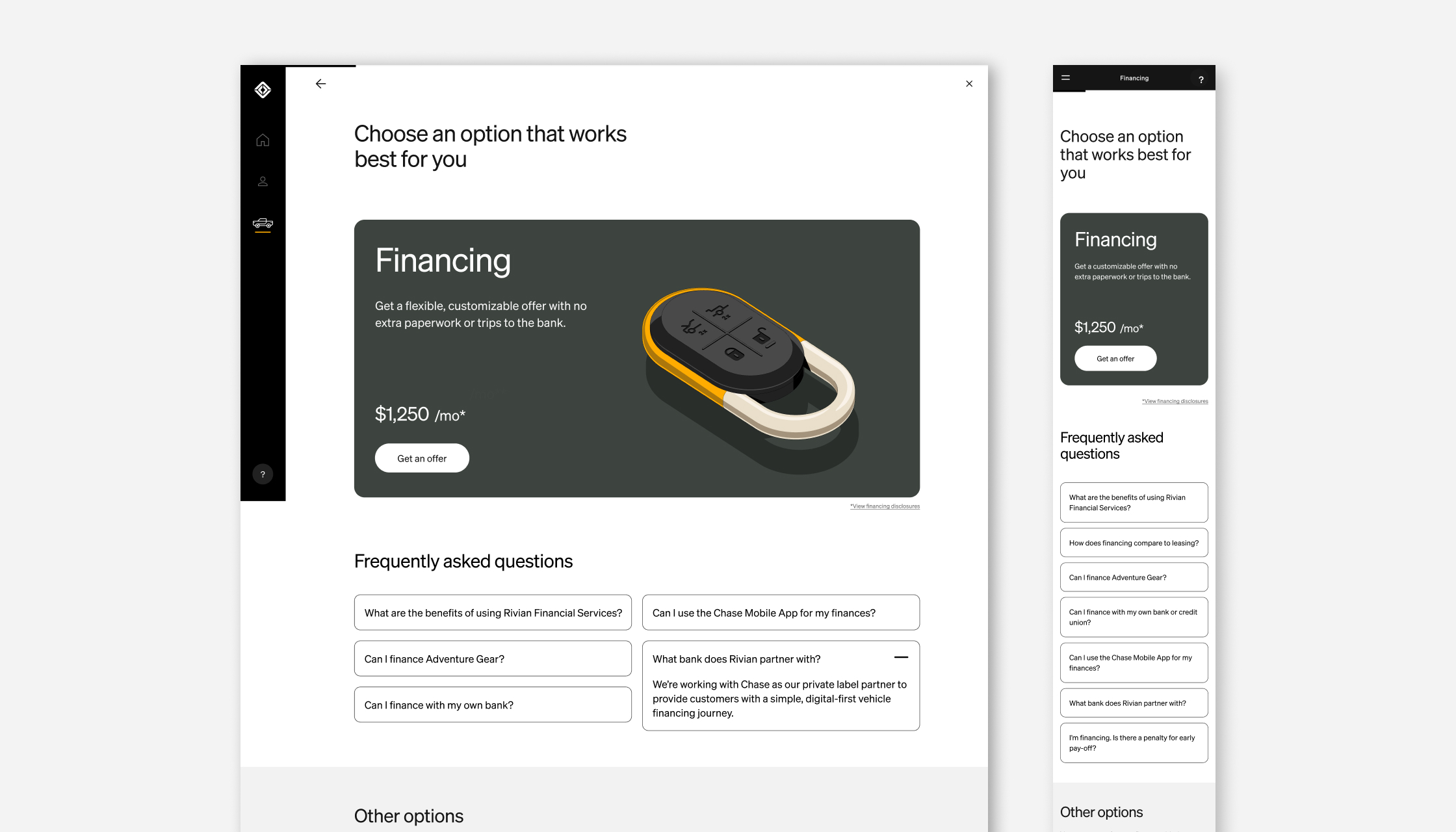

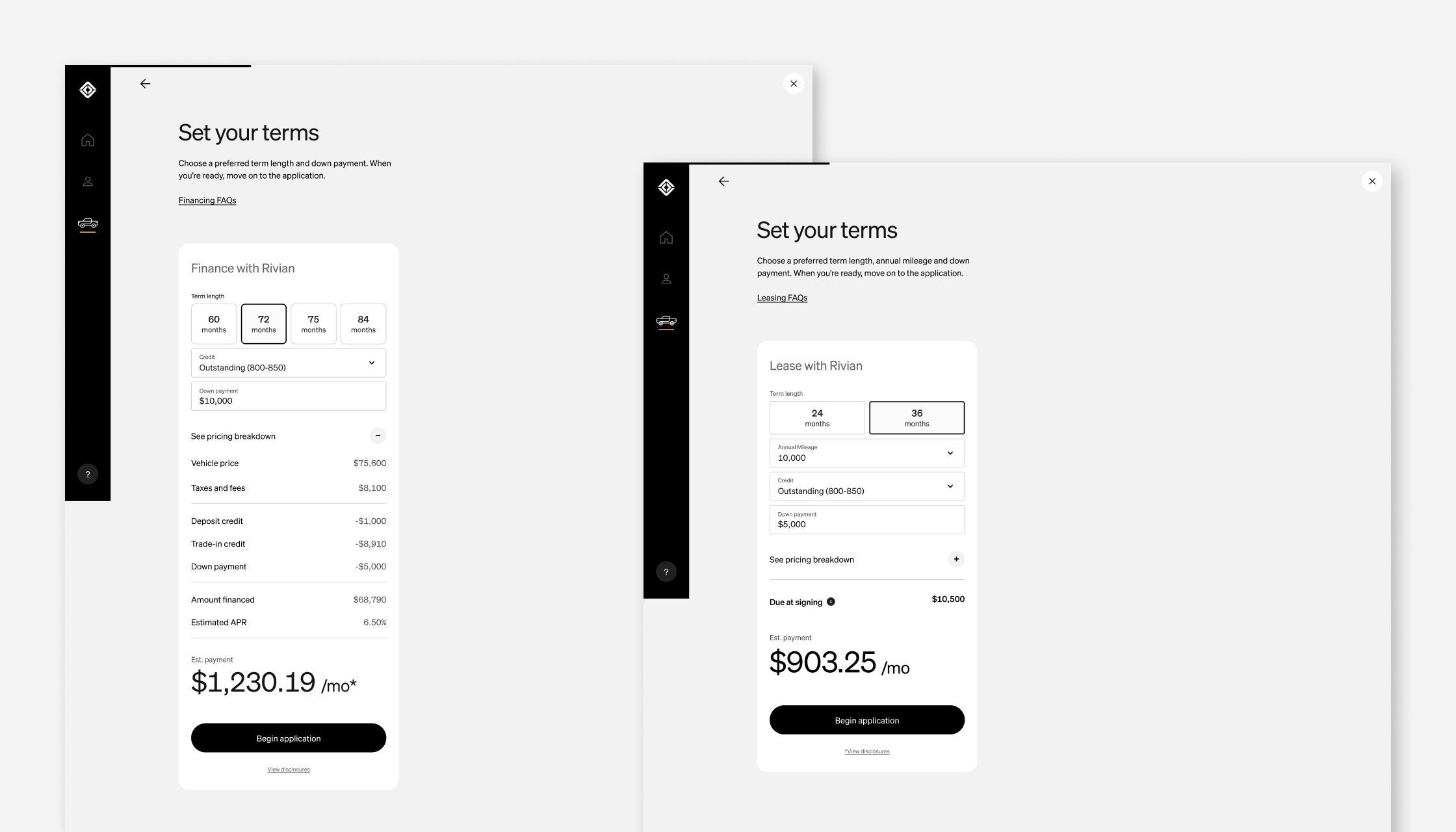

Backed with valuable data about what moves customers to convert, I was able to produce several rapid concepts. It was paramount to use existing components within our design system to ensure a speedy launch. This included redesigning the offer pages, the calculators and A/B testing different copy.

Data-driven design

Backed with valuable data about what moves customers to convert, I was able to produce several rapid concepts. It was paramount to use existing components within our design system to ensure a speedy launch. This included redesigning the offer pages, the calculators and A/B testing different copy.

Launch and monitor

The new designs were launched in our experience to real customers. I worked with our digital analyitics team to ensure heatmaps were activated in the new pages as to monitor usability.

Our designs were successful! "Get an offer" buttons were the most clicked on area on the page. Additionally, users that wanted to pay in full or use another insitution were not lost; this told us we did not create a dark ux pattern.

Conversion increased 10-11% almost immediately – this translates to an increase of $440k a month.

Ongoing monitoring

Post launch, I continued to work with my researcher and analytics team to continue measuring the success of the redesign. After 4 months, I outlined the design's impact in a deck to share wtih stakeholders.

Additionally, this deck was shared with other stakeholders outside of Financing to help influence a similar process and redesign elsewhere like with Insurance, Trade-In and Delivery.

Ongoing monitoring

Post launch, I continued to work with my researcher and analytics team to continue measuring the success of the redesign. After 4 months, I outlined the design's impact in a deck to share wtih stakeholders.

Additionally, this deck was shared with other stakeholders outside of Financing to help influence a similar process and redesign elsewhere like with Insurance, Trade-In and Delivery.